Known Issues

Issues discovered and currently being addressed are detailed here.

Create ACH Bank File Defect

Bug Numbers

- 7.1.x: 1443794

- 8.0.x: 1443740

Issue

An error was introduced in MR 8.0.7 and MR 7.1.16. In those MRs, we updated the Create ACH Bank File (PRPBANK) screen by adding the ability to generate a direct deposit file for multiple taxable entities in one file. This change introduced a potential error in the file. If a taxable entity's Tax ID is set up with a dash on the Configure Company Information (GLMCOMP) screen, the dash is not being removed in the direct deposit file, which is causing the file to be rejected by the bank.

Workaround

On the Configure Company Information (GLMCOMP) screen, query the Taxable Entity, update the Tax ID by removing the dash and then save the record. After this is done, regenerate the direct deposit file in the Create ACH Bank File (PRPBANK) screen.

Release Dates

Please check back. We will update this section with target release dates.

- 7.1.1 (on-premise): MR 7.1.17 (April 12, 2021)

- 8.0 (on-premise): MR 8.0.9 (April 30, 2021)

Create W-2s Defect

Issue

When the application determines that the employee has COVID sick/family leave wages, the application should check if an accrual or expense account exists on the Employee Earnings Timesheet Information (EMPL_EARN_TS_INFO) table. Previously, the application only determined if an expense account existed on the Employee Earnings Timesheet Information table. This issue would not occur if only an expense account (not an accrual account) is linked to the COVID sick/family leave type.

Target Dates for Bug Fixes

The following target dates are subject to change:

- 7.1.1 (on-premise): Hot Fix 7.1.14.1 (January 19, 2021)

- 7.1.1 (on-premise): MR 7.1.15 (February 8, 2021 - this target date is subject to change)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

Direct Deposit File Creation (Applies to 7.1.10, 7.1.11, 7.1.12, and 7.1.13 Only)

Issue

Prior to MR 7.1.10, payroll direct deposit files could only be generated for one taxable entity at a time. In MR 7.1.10, the Create ACH Bank File application was enhanced to allow creation of the direct deposit file for all taxable entities. However, when you use this new option, the application excludes the taxable entity information from the direct deposit file, which causes the file to be rejected by the financial institution.

This enhancement was not implemented in version 8.0.x.

Workaround

When generating a direct deposit file in the Create ACH Bank File application, select a Taxable Entity range option of One rather than All.

Solution

The ability to generate a direct deposit file for all taxable entities will be removed in MR 7.1.14. In a following MR, we will repair the issues and rerelease the enhancement.

Affordable Care Act (ACA) Electronic Filing

Issue

An AIRSH100 XML file schema validation failure error was encountered upon submitting the ACA tax year 2020 file to the IRS. This issue was caused by out of sequence elements.

Solution

The element sequence has been corrected in the Create 1094-C and 1095-C Data Electronic File application.

Additional Information - IRS Affordable Care Act 1094-C and 1095-C Due Dates

The 1095-C deadlines are still February 28, 2021 for paper filing or March 31, 2021 for electronic filing.

The deadlines were not extended for filing 1095-C forms with the IRS. The 1095-C deadlines are still February 28, 2021 for paper filing or March 31, 2021 for electronic filing.

Release Dates for Form Updates

- 7.1.1 (on-premise): MR 7.1.15 (February 8, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.7 (February 22, 2021)

- 8.0 (on-premise): MR 8.0.7 (February 26, 2021)

Affordable Care Act (ACA) Form 1095-C

Issue

As of early January 2021, the Affordable Care Act 1095-C form had not yet been released by our forms-providers. Therefore, we were not able to complete our updates to the form alignment in versions 7.1.13, 8.0.5, and 7.1.7.5.

Solution

1095-C alignment updates were released in January 2021 (see release dates below).

Additional Notes - IRS Affordable Care Act 1094-C and 1095-C Due Dates

On October 2, 2020, the IRS announced it would extend the deadline for employers to provide employees with a copy of their Affordable Care Act (ACA) 1095-C reporting form. The deadline extended from Jan. 31, 2021, to March 2, 2021.

The deadlines were not extended for filing 1095-C forms with the IRS. The 1095-C deadlines are still February 28, 2021 for paper filing or March 31, 2021 for electronic filing.

Release Dates for Form Updates

- 7.1.1 (on-premise): MR 7.1.14 (January 18, 2021)

- 7.1.7 Hot Fix (on-premise): Hot Fix 7.1.7.6 (January 27, 2021)

- 8.0 (on-premise): MR 8.0.6 (January 22, 2021)

Affordable Care Act (ACA) Form 1095-C Defect (Applies to 7.1.x Only)

Affected Version

This issue applies to 7.1.x only. It does not occur in 7.1.7.x and 8.0.x.

Issue

Dependents are not printing on page 1 of the Affordable Care Act 1095-C Portrait (Employee/Employer Copy) form. Any dependent data is instead printed on page 2 of the form.

Solution

The 1095-C report has been corrected so that up to 5 dependent rows will print on page 1 of the Portrait (Employee/Employer Copy) form.

Additional Information - IRS Affordable Care Act 1094-C and 1095-C Due Dates

On October 2, 2020, the IRS announced that it would extend the deadline for employers to provide employees with a copy of their Affordable Care Act (ACA) 1095-C reporting form. The deadline extended from January 31, 2021 to March 2, 2021.

The deadlines were not extended for filing 1095-C forms with the IRS. The 1095-C deadlines are still February 28, 2021 for paper filing or March 31, 2021 for electronic filing.

Release Date

- 7.1.1 (on-premise): MR 7.1.15 (February 8, 2021)

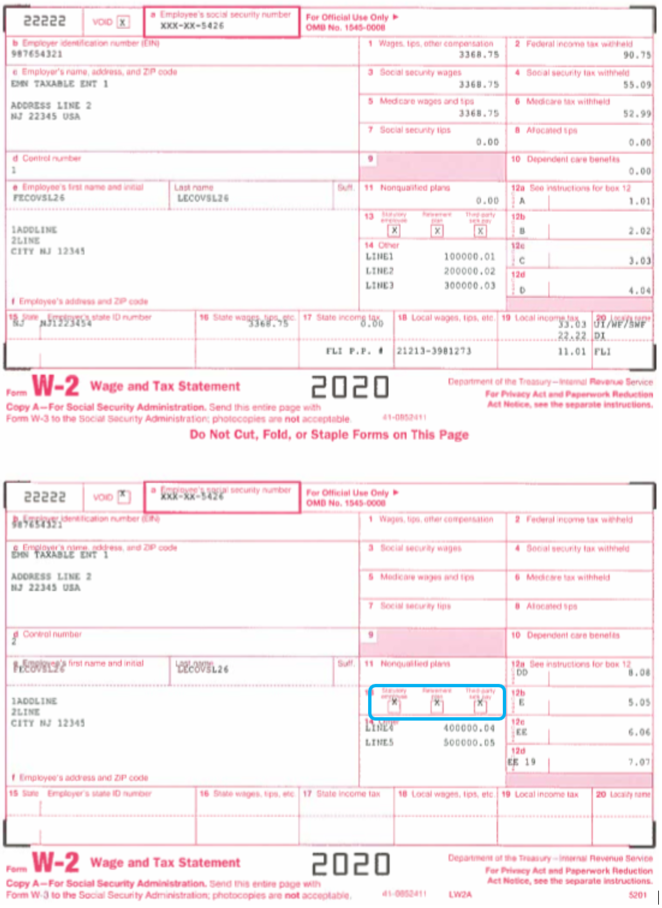

Print W-2s Defect

Affected Version

This issue only applies to MR 7.1.12, which is scheduled to be released to on-premise clients on December 4, 2020. MR 8.0.4 and the 7.1.7.5 hot fix are not affected.

Issue

Bug 1390967: When printing the 2-Up W-2, some of the values printed on the second W-2 on a page are printed too high in the field or check box. For example, if any of the Box 13 check boxes apply to the second W-2 printed on a page, the Xs are not fully printing within the box. Here is an example:

Solution

Bug 1390967 will be fixed in MR 7.1.13.

Release Date

- 7.1.1 (on-premise): MR 7.1.13 (January 8, 2021)

Payroll Toolkit Defect 1

Issue

There are currently two toolkits within the Payroll Toolkits application. Both are used in the processing of deferred Social Security tax repayments related to COVID. If you enter an employee range for one of the toolkits and then you switch over to the other toolkit and attempt to process that other toolkit, the following error message displays: "This Range Option's Starting and Ending value combination is invalid."

Workaround

- Click the Refresh button in the toolbar.

- Select Refresh All.

- Open the appropriate toolkit.

- Reenter your parameters.

Release Dates for Bug Fixes

- 7.1.1 (on-premise): Bug 1397239 - MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): Bug 1397240 – MR 8.0.5 (January 15, 2021)

- 7.1.7 Hot Fix (on-premise): N/A (7.1.7 was not affected by this issue)

Payroll Toolkit Defect 2

Issue

In the Create payroll records to repay deferred Social Security toolkit, the data selection does not work if you use an employee range type of Range or From beginning. Though valid records exist for processing, the following message will print on the report: NO ROWS FOUND THAT MEET SELECTION CRITERIA.

Workaround

If you need to run the toolkit using an employee range type of Range or From Beginning, please use the Employee Non-Contiguous Range subtask to specify your parameters. To perform this, complete the following steps:

- Select the Employee Non-Contiguous Range check box.

- Click the Employee Non-Contiguous Range subtask.

- Enter the appropriate parameters in the subtask.

This can be done by selecting the Employee Non-Contiguous Range check box, opening the Employee Non-Contiguous Range subtask and entering the appropriate parameters in that subtask.

Release Dates for Bug Fixes

- 7.1.1 (on-premise): Bug 1401435 - MR 7.1.13 (January 8, 2021)

- 8.0 (on-premise): Bug 1401446 - MR 8.0.5 (January 15, 2021)

- 7.1.7 Hot Fix (on-premise): Bug 1401447 - Hot Fix 7.1.7.6 (January 27, 2021)